In the late 1990s, after I'd run my business for a few years, I realized I'd have to start an individual retirement fund. Which meant that I would have to learn how the stock market worked.

This was not bad news for me. The stock market combines so many things I love in life: Money. Statistics. Mathematics. Human frailty. Laws. Money.

I tore into this project with great gusto. I read books. Read the financial section of the New York Times. Got horrible advice from financial advisers. And, in the end, I understood the logic that drives the stock market.

I learned this just in time for that logic to be entirely abandoned, as the stock market entered a strange Alice In Wonderland zone it has remained in for the last generation.

The stock market I learned about is gone gone gone. But, in the interest of history and whimsy, I'm going to explain the old theory of the stock market. It had a beautiful logic. Also, who doesn't like talking about money?

Disclaimer

I'm just a dummy who writes video games, so I don't really understand anything.

The stock market today is very important. Everyone's retirement and pension funds rely on it. Massive fortunes are being generated and lost in the most incomprehensible of ways. Millions of memelords are scrambling to make their quick, easy pile of cash before the bottom falls out.

To match our current needs, over the last 10-20 years our financial system has been twisted into a new glorious form. This economic redesign has been done by very smart people with very nice suits who could buy and sell me a thousand times over.

So I am not criticizing anyone or giving any advice. I'm not smart enough. I'm just describing the underlying logic of the stock market of a simple, lost time. (The 20th century.) If you've ever looked at your retirement fund and thought, "What is going on with any of this?" this lesson might give clarity.

Also, I can't give you advice about whether to buy Bitcoin or not. I would only observe that the frenzy over Bitcoin and NFTs and Diamond Hands and similar mystery sorcery shows an all-consuming lack of faith in the old system. So it might be worth a quick, nostalgic glance at ...

How Did the Stock Market Work?

I'm sure you know the basics. You buy a share of Apple. That means you own some of the Apple corporation. But. How much should that share have cost? Did I pay too much? Too little? I mean, eventually you want to sell it to some idiot for more than you paid for it, right? But what is the right price? And how do I know that Apple executives won't just take the company I bought, sell its equipment out the back of a truck, and pocket the money?

Right at this moment, I have no idea about any of this. Nobody really knows if Apple is too expensive or too cheap. If only there was a way, some sort of measure, to tell.

But in a previous century, those questions were answerable! Thus, this nostalgic little history lesson.

From first principles, let us begin.

What Is a Share of Stock?

When you buy a share of stock, you own a chunk of a company. If you own one millionth of the shares of Ford Motor Company, you own one millionth of Ford’s factories, and offices, and tires, and screws, and intellectual property.

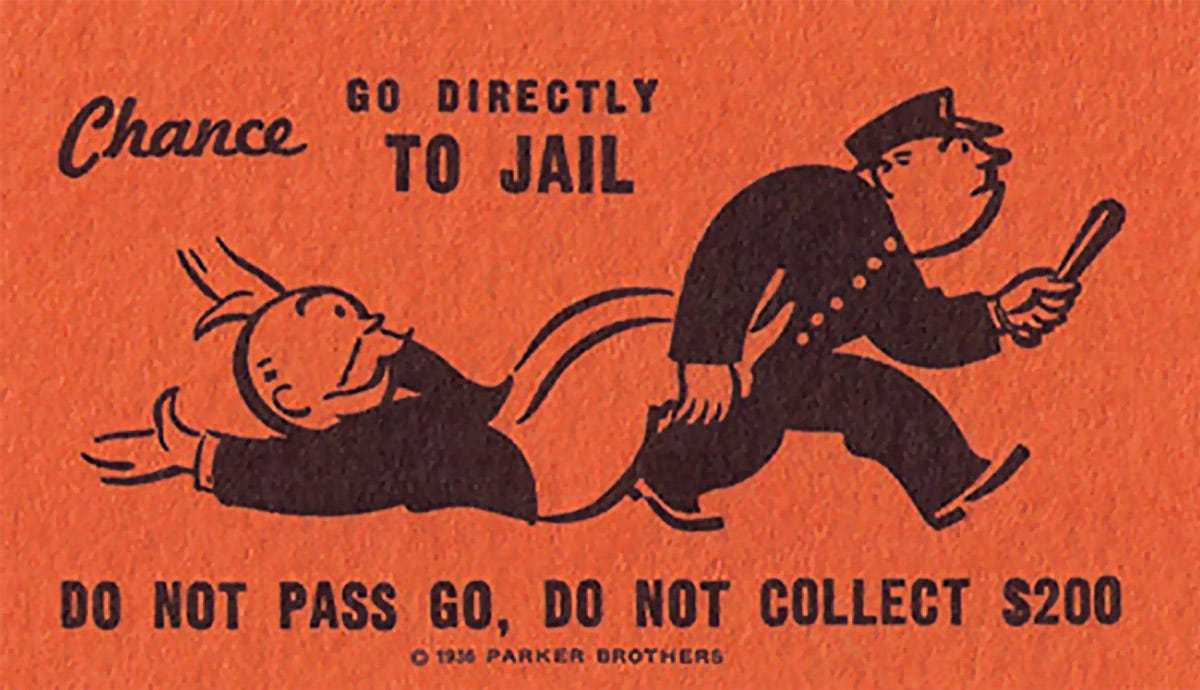

Note that this is a very clever sort of ownership. You own a fraction of the good stuff about the company, but none of the bad stuff. If Ford has a giant pile of debt and goes out of business, you can't be called on to pay the debts. If Ford commits a horrible crime (like lubricating its machinery with baby fat), you can't be taken to jail.

It has to be this way. If it isn't, the system won't work. Nobody will tolerate being sent to debtor’s prison because one of the 90 companies in their retirement fund went rogue.

Why Do I Want To Own a Bit of a Company?

The reason to own any business is to make money. You want your business to earn profits, which you can then spend on goods and services.

Businesses earn profits, which go to its owners. That is why we run our little software company.

So if you own some of Ford and Ford turns a profit, you should get some of that cash.

I Love Money! How Does It Get To Me?

Suppose you own some Ford stock. And, at the end of the year, Ford has made some profits. It will hang on to some of them for research, expansion, investment, and so on. All ways it can grow the company and generate even more profits to give you.

The rest of that money is distributed among its owners (You). This money is called a Dividend.

Who Decides If I Get Any Dividends Or Not?

You own some of Ford, but you don't want to spend your time running the company. You're a busy person.

Fortunately, you don't have to run Ford. Instead, the shareholders run elections to vote on the people who run the company for them. These people are called the Board of Directors. The Board makes all sorts of decisions about how to run the company. Like how much of the profits get paid to you as dividends.

Does the Company WANT To Give Me Dividends?

NO! Of course not! Nobody likes giving money away!

The job of the Board of Directors is to force them to give you the profits. (Which they should. Remember, it is YOUR money. Not theirs.) If they don't, you can vote them out.

(In olden days, people who owned tons of stock in a company, like super-rich people and big mutual funds, would constantly lean on the Board to pay lots of dividends. Nowadays, Boards tend to be more concerned with being chummy with the company executives than actually looking out for the interests of little people like you. Oh well.)

How Much Dividend Should I Expect?

OK, now we're getting to a key question. Suppose you own a stock. You want money out of it. How do you know if it's a good stock or not? How do I know if I'm getting my money's worth for owning it.

Because remember, owning a stock is RISKY. Companies decay and go out of business all the time. You need to get a decent payment to make up for your risk.

The dividend a stock pays is measured in the percentage of the stock price it is. This is called the stock's Yield. Suppose a share costs $100 and this year you get a $10 dividend. Then your yield is 10%. If you only got $5, the yield is 5%.

If the company doesn't turn a profit, your yield is going to be 0%. Not good. If you own this stock, you are hoping it starts to make a bunch of money in the future. (More on this later.)

Suppose your company makes money. Yay. What is a good yield?

Well, suppose you could get 3% interest in your bank account. (Remember, we're talking about the distant past, when bank deposits earned interest.) Then a stock that pays a 3% yield is not great. Why? Because stocks are risky, and bank accounts are safe. The smart move would be to sell that stock and just put your money in the bank.

So What Is a Good Yield?

Depends on the company. If it's a really safe, stable business, like electricity or food, the bank interest rate plus a few percent is pretty good. For a riskier business, you'd expect more.

For reference, historically (chart here), the average yield of the stock market is around %4.3. So lots of companies were paying a dividend of well over 4%. (It’s useful to look at that graph and see what happens to the dividend rate starting around 1990. We really are talking about ancient history here.)

Note that, at this point, we have completely diverged from how the stock market works now. "Dividends? Interest on bank accounts? What weird, science-fiction world are you describing, blog-weirdo? Nobody pays dividends anymore!"

I'll get back to this.

So That Is How You Used To Tell If a Stock's Price Is Fair

The price is fair if it is generating enough cash for you.

There are other ways to tell if a stock is overpriced, or not. The most popular is the Price to Earnings Ratio (or P/E Ratio). This is the ratio of the stock's price to how much the company earns in a year. A big number means the stock is more expensive.

I'm not using this measure to evaluate a stock's price for two reasons. 1. P/E Ratio is very easy to game with accounting tricks. 2. I can buy food with dividends. I can't buy food by owning stocks with a good P/E Ratio.

What Makes a Stock's Price Go Down?

Suppose your company screws up and its profits go down by half. Suppose, before, it had a solid yield on your investment of 8%. Now it's return on your investment is 4%, which sucks.

(And imagine if your company doesn't earn any profits at all, or even loses money! Yuck!)

Now owning this stock is bad, so a lot of people will sell it. There is more supply of the stock and less demand, so thanks to the Law of Supply and Demand (which is still a thing some people have heard of), the stock price will go down.

Suppose the stock price goes down by 50%, matching the profit drop of 50%. Then its dividend yield is back to 8%, which is solid. Stability has been restored to the universe.

What Makes a Stock's Price Go Up?

Suppose your company does great! Its profits double!!! Before, its dividend yield was 8%. But now it's 16%! That's crazy good!

Lots of people are going to want to get in on that action. So they try to buy the stock. Demand goes up, but the supply is constant. Which means the stock's price goes up. It probably goes up until its price doubles, returning the dividend yield to 8%. Stability is restored to the universe.

But this is a fantastic deal for people who already owned the stock. They are not only earning twice the money, but they can sell their stock for twice what they paid. This is called Capital Gains, and they are sexy.

One quick note about this theory about why stock prices go up and down: It makes SENSE. There is logic to it. It's not like the price of Bitcoin, which lurches up and down like crazy and nobody knows how much Bitcoin should be worth or what it will be used for.

What If A Stock Doesn't Pay Dividends? Does That Mean It Sucks?

A great question. Suppose a company doesn't make profits right now. Does that mean it's stupid to own it? Not necessarily. That is the difference between a Value and a Growth stock.

A Value stock is a nice reliable company that is earning profits and giving it to you. A good, sensible buy, but it's not going to surprise anyone or take over the world. Utility companies are the ultimate example of this. Everyone wants electricity, but they're not going to want surprisingly huge amount of electricity. A power company will always earn profits, but a moderate amount.

A Growth stock is a company that isn't making money now, but it's growing fast. You own it because you believe it will eventually earn piles and piles of profits. And then give those profits to YOU. Because you own them.

Of course, this is only the beginning of this subject. There are ten million things I could explain. Why does a company Go Public (i.e. start selling bits of itself)? What is Short Selling? What is a Mutual Fund, and what is an Index Fund? A Hedge Fund? Insider trading? This is a DEEP topic. But this isn't a stock primer. It's a history lesson. So here is one instructive bit of history.

An Instructive Real-World Example

I live in Seattle. We buy the energy that cooks our food and keeps us warm from a utility company called Puget Sound Energy, PSE for short.

When I first started my business, my grandfather advised me to buy PSE stock. And I did. It was a good, stable investment. Utility companies pretty much always make money, and PSE paid dividends like clockwork.

I soon learned that PSE stock was a major part of the retirement plans of people who lived around here. When people had jobs, they bought PSE stock. When they retired, PSE dividends helped them buy food. The PSE dividend yield was news around here. There were articles about it in the paper. It mattered.

Anyhoo, one day, I looked at my stock fund monthly report and saw that PSE was gone. I had more cash, which was nice. But PSE had vanished.

Turns out, our gas company was bought by a bunch of rich Australians. And then it got passed along, like a pack of smokes, to the Canadians. It was no longer a safe retirement option for our local pensioners. Now it is in the digestive system of the global financial system, a part of the gigantic money manipulating structures no mere human can ever comprehend.

Now that PSE is owned by oligarchs, I’m not sure what I'm supposed to buy to have a chance of eating something better than dog food in my retirement. I'd buy a building and rent it out, but landlords in Seattle aren't allowed to collect rent anymore. I hear Dogecoin is sexy.

Back To Our Wise, Beautiful Future

Of course, this is just a history lesson. I can imagine the savvy investors of glorious 2021 laughing at me as they read it.

"Dividends? This old fossil still cares about DIVIDENDS!?!? HAHAHA! Go to bed, old man!"

The system I just described is as dead as the dodo. It has to be dead. It can't be allowed to return. Here is why.

Consider Apple Computer, the mightiest corporation on Earth. It's P/E ratio, as I write this, is 36. Which means it generates about $3 in profit for $100 in stock price. Which means that the highest dividend yield it can possibly pay is 3%. Which, as we have seen, sucks. Historically speaking.

For Apple Computer to pay adequate dividends, it has to triple its profits. Maybe this can happen. I doubt it. We can't even reliably get computer chips anymore. And this is the BEST corporation.

(This is a fun game. As of this writing, the P/E for Google, Amazon, Microsoft, and Netflix are 24, 81, 40, and 90. So the biggest profit yields they can possibly give their owners are 4%, 1.2%, 2.5%, and 1.1%. React accordingly.)

As of this writing, the dividend yield for the S&P 500 is a comically low 1.38% So, for my old person system to exist again, one of two things need to happen. The profits for the economy need to increase fivefold. (Won't happen.) Or stock prices have to drop. A LOT.

Like, stock prices have to drop enough that every pension fund in the country will crater, taking the rest of the economy with it. Stock prices HAVE to stay as high as they are. So my old person system can't be allowed to exist.

And that is why you are laughing at me for talking about it.

This Concludes the History Lesson

I hope this view into an impossible past has been amusing. I don't know what should be done or what you should buy. I don't understand the current financial system. Happily, as far I can tell, nobody else does either.

I do know one thing. When dividends don't exist, there is only one way to make money on a stock: Sell it to someone who will pay you more for it than you paid. You can always find someone who will pay more. This is called the Greater Fool Theory. Which works great, except for one thing. Eventually, invariably, you run out of fools. And then things get wild.

“If something cannot go on forever, it will stop.”

- Herbert Stein

If you liked this, you can get free writings in your inbox for free by subscribing here.

Excellent post Jeff. As a Financial Advisor who has to survive in this wacky system you really hit the nail on the head. The irrationality of the stock market these days has certainly kicked the old "tangible value" system to the curb. Obviously, there is still value in dividend of "value" stocks but they just arent sexy and wont turn you into a millionaire overnight :). Thanks for the relevant and entertaining posts. keep 'em coming!

You're neglecting, in your analysis, the historical growth of these firms' profits and revenues. It is not unreasonable to expect a firm to grow by a lot if it has shown an ability to grow a lot before. Other firms, like JP Morgan Chase and Bank of America do not have such large valuations and more modest growth. There are also ways besides dividends for firms to return profit to shareholders. Share buybacks are very real.

There certainly are some firms with overly high prices. But most are, if not fair, at least reasonable. Consumer goods firms tend to be less so because a lot of people buy their stock because they buy that firm's products, but don't perform any analysis at all. If you check some non cosgood firms you may be surprised by the reasonableness of their prices.